In the dynamic world of Digital Agencies, where innovation and intellectual property (IP) are at the forefront, there exists a golden opportunity to capitalise on qualifying expenditure.

By quantifying your salaried team’s involvement in software development and the development of other intellectual property, your agency can not only increase reported profits but also enhance the overall value of your balance sheet.

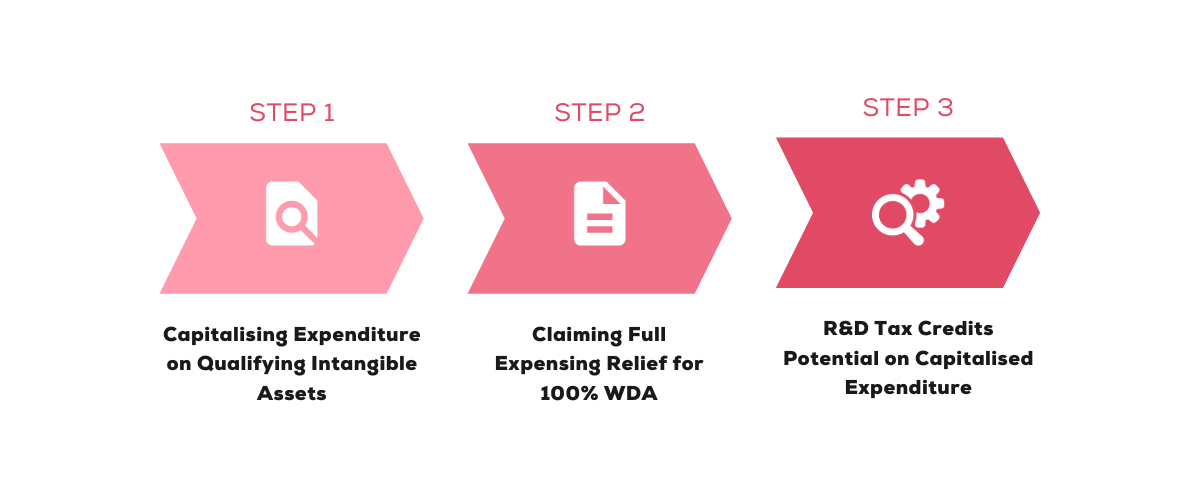

In this blog, we’ll guide you through a three-step process to leverage this opportunity to make immediate savings.

Step 1: Capitalising Expenditure on Qualifying Intangible Assets

The first step in unlocking hidden value is to identify and capitalise on qualifying intangible assets. This involves recognising the value generated by your salaried team’s intellectual endeavours, such as software development or the development of other intellectual property. By capitalising on these intangible assets, you shift their treatment from an immediate expense to a long-term asset, thus spreading the cost over several accounting periods.

This not only enhances the reported profit by reducing immediate expenses but also serves to reflect the true value your agency generates over time. Be sure to adhere to accounting standards and seek professional advice to ensure accurate identification and valuation of these intangible assets.

Step 2: Claiming Full Expensing Relief for 100% WDA

Once you’ve successfully capitalised on qualifying intangible assets, the next step is to claim full expensing relief. This allows your agency to write down the entire cost of the qualifying expenditure in the year it was incurred, known as a 100% Writing Down Allowance (WDA). This not only provides an immediate boost to reported profits but also frees up cash flow by reducing taxable income.

By leveraging full expensing relief, your agency can accelerate the recognition of the value created by your salaried team’s intellectual property, whilst still obtaining full tax relief in the year the costs were incurred.

Step 3: R&D Tax Credits Potential on Capitalised Expenditure

Beyond the immediate financial benefits of capitalising on qualifying intangible assets and claiming full expensing relief, Digital Agencies may be eligible to further enhance their bottom line through Research and Development (R&D) tax credits.

Many agencies are unaware that the capitalisation of qualifying expenditure can make them eligible for R&D tax credits. These credits can provide a significant cash injection, or reduce tax liabilities, contributing to the overall value of the balance sheet.

Below we look at an example for a profit making agency with £100,000 of qualifying staff costs.

Before Capitalization and R&D Tax Credits

Profit and Loss Statement

Taxable Profits: £350,000

Corporation Tax at 25%: £87,500 (350,000 x 25%)

Balance Sheet

No capitalisation of qualifying intangible assets

After Capitalization and Full Expensing Relief

Profit and Loss Statement

Qualifying Expenditure Capitalised: £100,000

Adjusted Taxable Profits: £350,000 (no change in taxable profits, as the £100,000 staff costs are simply replaced by £100,000 of capital allowances)

Corporation Tax at 25%: £87,500 (350,000 x 25%)

Balance Sheet

Intangible Assets (Qualifying Expenditure): £100,000

After SME Scheme Enhanced R&D Tax Credits

Profit and Loss Statement

R&D Tax Credits (86% of Qualifying Expenditure): £86,000

Adjusted Corporation Tax payable: £1,500 (£87,500 – £86,000)

Balance Sheet

Intangible Assets (Qualifying Expenditure): £100,000

In the competitive landscape of Digital Agencies, it’s crucial to seize every opportunity to enhance financial performance and make immediate tax savings.

By quantifying your salaried team’s involvement in software development and the development of other intellectual property, your agency can unlock hidden value, boost reported profits, and make immediate tax savings.

Don’t let your intellectual property go unrecognised – capitalise on it to thrive in the digital age.