Employee Benefits can be confusing so we’ve put together this guide to help you to identify and navigate Taxable Benefits and how to declare them.

**Disclaimer: This information is correct for the 2023/24 tax year only. For up to date information, contact MAP.

What is a Taxable Benefit?

Any item or service supplied to an employee in addition to their salary could potentially be a taxable benefit. A taxable benefit:

- Has a monetary value

- Is not required for an employee to perform their duties

- Is not exempt through legislation

For each non taxable benefit there are always extra criteria to meet:

Pensions, for example, are considered a non taxable benefit provided the total scheme contributions have not exceeded the limit set by HMRC for the year. Once they do, tax is due.

Work equipment, laptops, chairs and office furniture, are also not considered a taxable benefit unless ownership is directly transferred to the employee. As an example, MAP owns the laptop that this guide has been written on. If ownership were transferred to the person using the laptop, then the value of the laptop would become a taxable benefit.

How do I check?

We’ve prepared a helpful chart below that shows the most common taxable benefits we see here at MAP and how to correctly declare each with HMRC. We have also included some helpful links to the official lists that HMRC publish and update in the resources section of this guide.

You will need to check your accounts to see if any of these items have been paid to or on behalf of employees. Your contact owner can assist you with this.

If in doubt, please contact us. We will be able to tell you for free whether your benefit is taxable or non taxable, and how to correctly declare it.

The most common taxable benefits we process are:

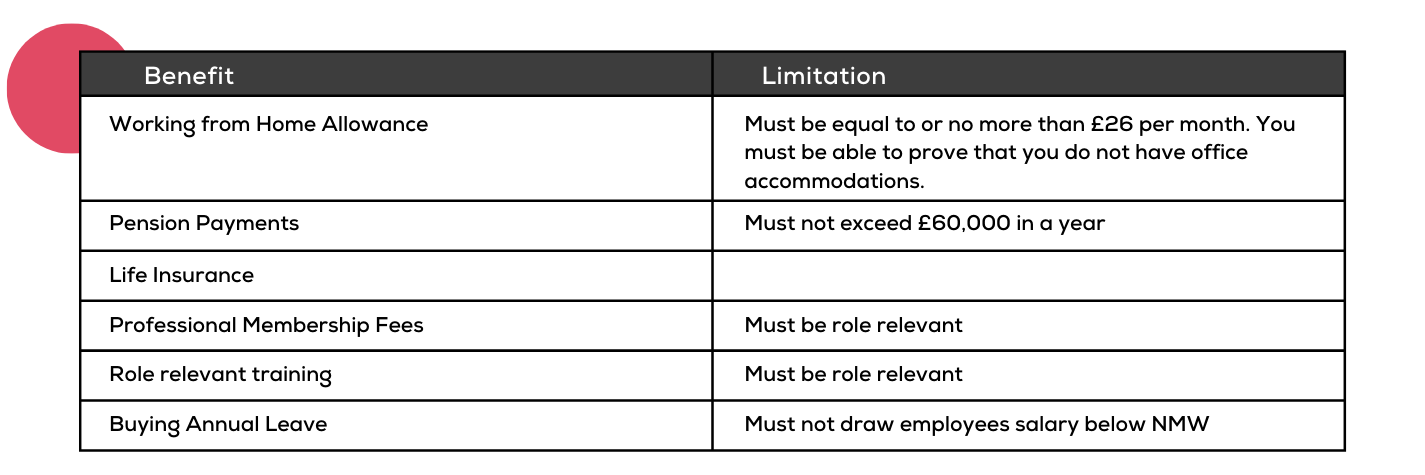

The most common non taxable benefits we process are:

Director’s Loan Accounts

Any Director’s Loan Account where the balance has exceeded £10,000 owed to the business in any month in the tax year, must be declared as a benefit in kind. The cost of the benefit is calculated using the opening and closing balance, with the maximum balance used as a modifier. If you are unsure whether or not you have any qualifying loans, we can check this for you for free.

What is a P11D?

A P11D is a form that must be completed between the 06th of April and the 06th of July. This declares all benefits where the tax responsibility falls with the employee. Once the P11D is submitted, your employee will be issued with a new tax code to cover their part of the liability, and you will be required to pay the Employer’s Liability, which in this case would be NI contributions. These will be submitted to HMRC using a P11D(b) form.

What is a PSA?

A PAYE Settlement Agreement (PSA) must be completed between the 06th of April and the 05th of July. This declares all benefits where the tax responsibility falls with the employer. The first year of setting up a PSA involves a negotiation with HMRC, each subsequent year involves filing the updated figures for the relevant tax year.

How does this affect my business?

All Taxable Benefits require the employer to pay Class 1 National Insurance contributions on the cash value of the benefit.

This is calculated at 14.53% of the cash value of each benefit. Once a P11D has been submitted, any Class 1 NI due will need to be paid by 22nd July 2023. This will show on your online PAYE account as a separate item in your annual statement.

How are employees taxed?

HMRC will issue an updated tax code to reclaim any tax due for your employee. As an example, if an employee receives a benefit of £200 and pays tax at the basic rate they will need to pay an additional £40 which will be collected evenly throughout the remainder of the tax year.

From the employee’s perspective, this means that the benefit effectively ‘costs’ them £40. So it should be seen as a reduced price for a service rather than a ‘free’ service.

Directors who are required to file a self-assessment will need to include the amount due for their taxable benefits in their self-assessment return, and will pay the extra tax after this has been filed.

Can I Payroll my benefits?

You absolutely can. We can assist you in preparing to switch from P11Ds to Payrolled Benefits. All companies must start declaring their benefits via Payroll from April 2025. You can only switch to payrolled benefits every April. If you’d like to switch to payrolling your benefits, please contact us and we can start the conversation.

Payrolling your benefits is better for employees, who are less likely to have confusing tax code changes. The tax is processed month to month and changes can be applied immediately. You also have the benefit of not having to complete the P11D process after each tax year, which saves you valuable time in spring and summer.

What is the cost?

MAP charges for preparing and submitting a P11D depend upon the number required:

- One – £60

- Between 2 and 9 – additional £36 per P11D

- From 10 up to 19 – additional £24 per P11D

- From 20 and above – additional £12 per P11D

For example, if 5 P11Ds are submitted the cost will be 1x £60 + 4x £36 = £204. In addition to this, a premium will be charged if either of the following benefits needs to be reported:

- Company car/van – £50 each

- Interest-free or low-interest loans – £30 each

If there are any additional items to be included, we’ll contact you to discuss the pricing for this separately. Once we’ve calculated the number of P11Ds required, you’ll receive a proposal from us via e-mail outlining the costs.

PSA charges are available upon request, please ask your contact owner for more information.

What happens if I miss the deadline?

If you miss the deadline, either by not declaring your benefits, missing something off, or by returning your filing late, you can be charged by HMRC. The severity of this charge is based on how HMRC views your efforts to ensure that all appropriate amounts are declared.

You’ll pay a penalty of £100 per 50 employees for each month your filing is late, plus interest charges on the NI due, starting at 5% and rising to 15%. MAP will also need to charge you for the extra time that will be required to submit your P11Ds close to or after the deadline.

We can only assist you in avoiding these fines if you choose to engage MAP to deliver our P11D and PSA services.

Resources:

The links below contain more information about taxable benefits:

HMRC A – Z of taxable benefits: https://www.gov.uk/expenses-and-benefits-a-to-z

HMRC Expenses and Benefits for Employers: https://www.gov.uk/employer-reporting-expenses-benefits

As always, if you have any queries about this or need our assistance in completing the form, please do not hesitate to contact us.