An agency’s growth often outpaces the effectiveness of its finance function.

A well optimised back office is essential in ensuring you are growing in the right way, but it’s harder to progress further without clarity of direction and experienced financial leadership.

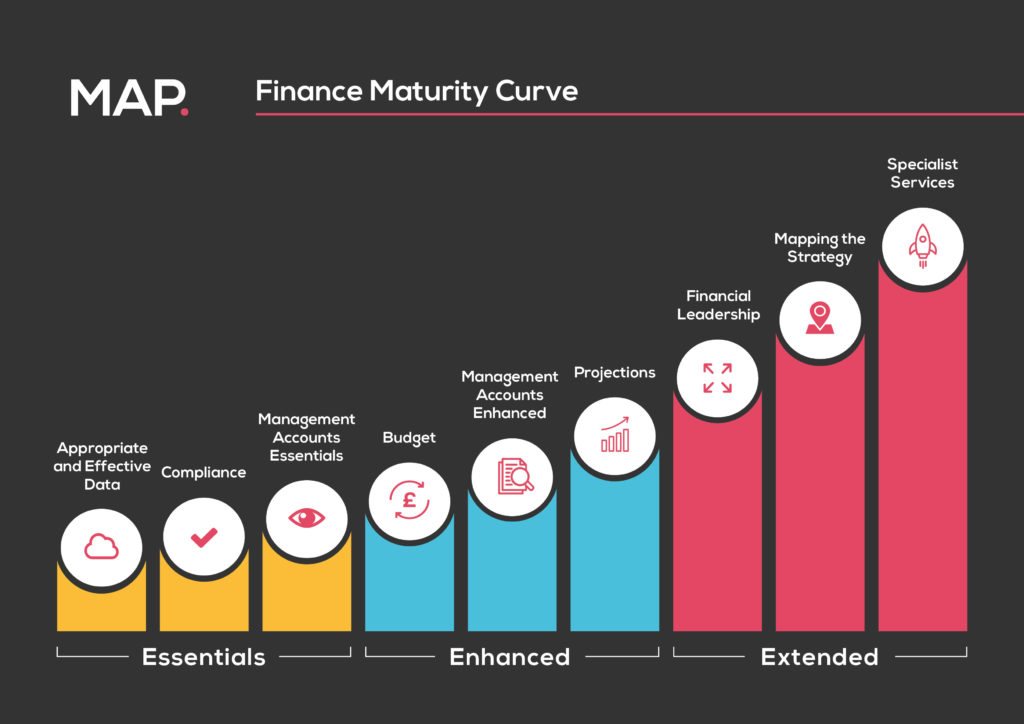

The Finance Maturity Curve is a way in which digital agencies can assess the strength of their operating model, by pegging the strengths and weaknesses of their finance function against a set of disciplines with clearly defined outcomes.

The more established the business, the further along the Finance Maturity Curve we would expect them to be, but this may not actually be the case. Identifying areas for development shows where improvements can have the greatest impact, and how long it might take to get there.

To make the process of evaluating easier, we have created a simple to use Finance Maturity Scorecard which takes you through a series of Yes/No questions to produce an overview of current performance and how you might start to improve.

| “You can’t build a successful business without access to the right financial information. This scorecard gives you the methodology to build the right habits.” Rob Borley Managing Director, Dootrix |

The Finance Maturity Curve is broken down into a number of key phases which allow you to investigate more clearly where improvements could be most effective.

Each element can be explored to understand if it is in place, of high quality, consistently delivered and as efficient as possible – regardless of whether it is in house or with external support.

Phase one: Essentials

Essentials are exactly what they imply: the fundamental systems and processes that every business needs to operate and optimise to not only keep going, but to fulfil your reporting obligations and your desire for growth.

And it’s all rooted in the data. The Essential record keeping that drives your understanding of the whole business, mastering your invoicing and managing suppliers, keeping you compliant, and delivering insights that will reveal your true business performance.

Essentials are the things that mean you can sleep at night because they are being delivered in a way that is stress free, reliable and accurate.

Read more about the Essentials phase

Phase two: Enhanced

With good quality data coming through the ability to draw upon the numbers in a more sophisticated way becomes possible. With a thorough budget for the year ahead in place, reporting becomes against the most meaningful benchmarks there are: your own plans and goals.

An Enhanced finance function develops beyond what is happening to create analysis and the story which you can use to shape decision making. It provides the narrative behind the headlines and incorporates the most appropriate KPIs to provide evidence, and to ask questions of your management team.

While it can’t predict the future, it should provide a valid view of how things will look so you can plan ahead.

Read more about the Enhanced phase here

Phase three: Extended

We have seen over the business life of an agency their need to draw upon experience that is naturally beyond the regular operational and reporting requirements that their finance function is able to deliver.

While the first two phases are repeatable every month, quarter, or year, Extended tends to be more specifically project focussed. It is a way of recognising where external intervention by an experienced high level professional can be most powerfully deployed and play a transformative role.

This could be to help formulate strategic plans, bolster the capabilities of the finance function, or lean on specialist services in corporate finance, tax or employee share schemes.

Requiring Extended services is a hallmark of culture and a level of financial maturity that means that the agency is at the stage where it is able to think and act upon the greater purpose of the business, rather than just commercial performance.

Find more about the Extended phase here

By completing the Finance Maturity Scorecard you start the journey of turning what you think you understand about your finance department’s capabilities, into a genuine conversation starter about how things might develop into an exciting future.

MAP is built on having these conversations, discovering and supporting agencies through their unique journey.