A digital agency’s growth and prosperity is aided by having the right financial foundations.

To some this might mean how much cash there is in the bank, however in reality it means having the right data and processes in place, staying on top of compliance and having insight into true business performance.

Without this base you can lose control of the levers which can shape and optimise the business for profitability and growth.

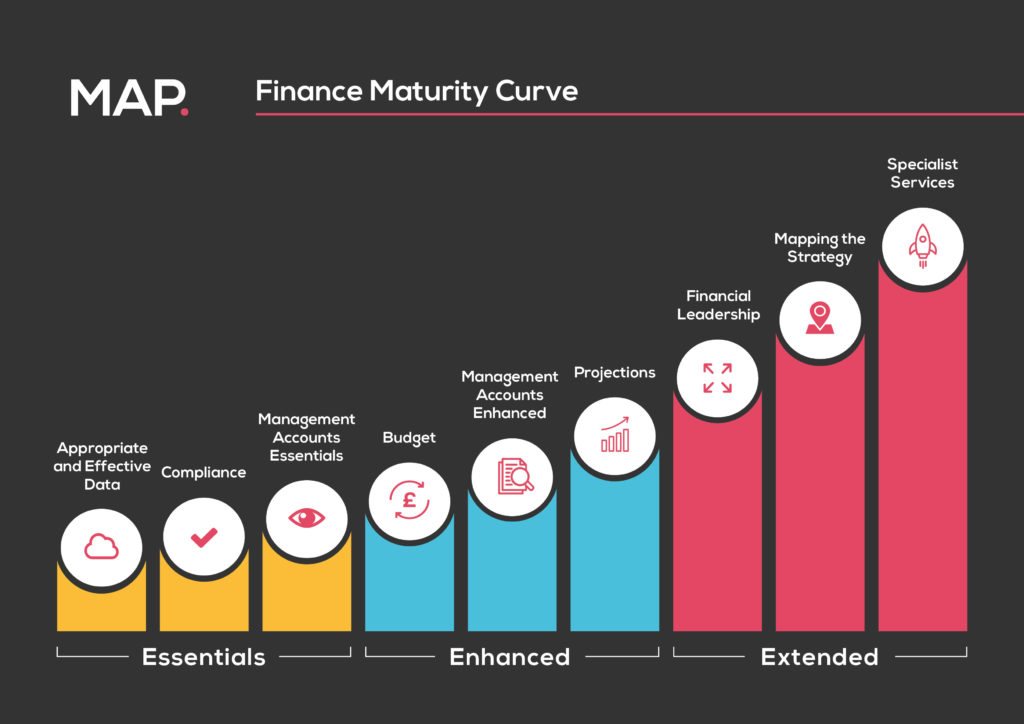

In the Agency Maturity Curve, this sits under the first phase called Essentials.

Essentials breaks down into three distinct elements, each of which should be in place, be of high quality, consistently delivered and as efficient as possible.

To help see where you sit on the Finance Maturity Curve, and which aspects of Essentials may need your attention, we have created a simple to use Scorecard –

| “Without the right financial rigour in place, you will never optimise your business. The scorecard shows how to prevent profit from leaking out of a business.”

Hannah Eames Finance Director, Space48 |

Essentials step by step

Appropriate and effective data

Technology that scales with you

Ensure you are leaning on the most appropriate technology in order to keep manual processing to an absolute minimum.

Automation and integration with other systems can bring tangible efficiencies if deployed correctly. It can make sure that you are growing with the right systems, rather than just adding more people into your finance team as things get busier.

Data that can be used, not just collected

Having the right disciplines around your data can save huge amounts of time and increase its usefulness to the whole business. Spending the attention in getting this right is so important as many of the later processes and insights you need will be based directly from here.

If you are looking for meaningful management information, the focus has to be on quality categorisation of your data. Starting with what it is the team needs to know and be able to discuss, draws a line to how the revenue and cost lines need to be established, and in turn how invoices and receipts are coded.

Regular reviews of the mapped financial processes (who/what/when/how) will help to focus on having the right routines in place so you don’t need to worry.

Clarity on what can be collected, and what needs to be paid

Being in control of the mechanisms of receiving money into, and spending money out of the business is not just about sending invoices and capturing receipts. This flow of cash needs careful attention if you are to have the processes and procedures in place to reconcile with your day to day running of the business, and your longer term goals.

Best practice here includes making sure you have clear commercial contractual terms from the outset; that the lines of communication between you and your suppliers and clients are clear, and that your approach is also based upon human relationships not just technology.

Compliance

There are real benefits in getting your statutory requirements not just done, but ahead of time, accurate and stress free. Working close to the wire can put you at risk of missing deadlines, creating unwanted pressure and increasing the chance of errors.

Compliance also has an important role in presenting your company to the wider world and puts your reputation in the spotlight. Aspects of your reporting can be used to assess creditworthiness, and errors with VAT, Payroll, or even P11D can bring unwanted scrutiny from HMRC.

Ensuring you have a reliable and consistent way of handling all your compliance areas should be a hygiene factor, however scouring the business to find and manage risk is a signifier of a more mature approach.

Management Accounts – Essentials

Valuable insight based on an accurate account of past performance

Conversations around business performance begin when the intelligence is there and shared for all to see. At the Essential level this is about assessing trends based on sound historical fact.

Meaningful profit and loss and balance sheet reporting are at the core, and the more that these can be reliably compared to prior periods, the more information is released back to the management team.

Once you know what you are looking at today, you can move forward more confidently tomorrow.

Examining the Essentials

You might feel like you have most of the essentials in place, and if so that’s great.

However, taking another objective look is likely to reveal areas which could still do with improvement. And realising these improvements can take time.

Getting under the skin of what is happening within a complex area such as finance usually surfaces quick wins, but taking this approach will also show the importance of building financial maturity into the fabric of your model.

MAP specialises in helping Digital Agencies in this journey through bringing together technical, industry, accounting, and commercial expertise into one place.

Complete the Agency Maturity Scorecard and see how we can help deliver for you.