Many businesses view Xero as an efficient bookkeeping tool, great for managing daily transactions and reconciling bank accounts. While it excels in these areas, limiting Xero to mere bookkeeping means missing out on its true power as a comprehensive accounting system capable of providing invaluable financial insights and strategic direction.

The Bookkeeping Mindset: A Limited View

When used solely for bookkeeping, Xero primarily serves to:

- Record Transactions: Inputting sales, purchases, and expenses.

- Bank Reconciliation: Matching bank statements with recorded transactions.

- VAT Filing (Cash Basis): Calculating and submitting VAT returns based on cash movements.

- Basic Reporting: Generating simple profit and loss statements or balance sheets that might not align with statutory filings.

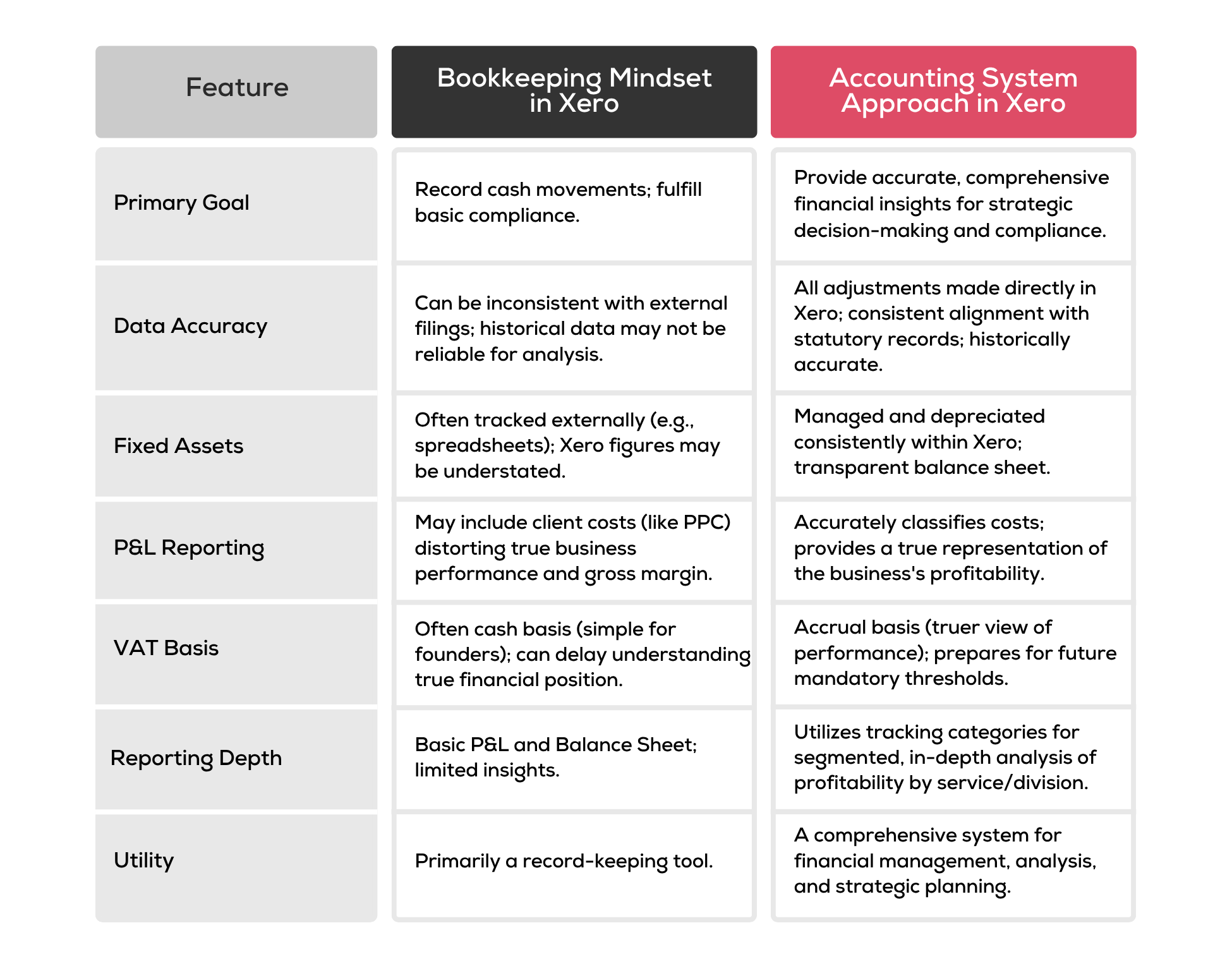

This approach often results in a “cash perspective” of the business, where data reflects money in and out, but not necessarily the true financial position or performance. Discrepancies between Xero and official company records (like Company’s House filings) are common, as year-end adjustments are often made externally and not integrated back into the system. This leads to historical data inaccuracies and limits the usefulness of month-on-month financial analysis.

The Accounting System Approach: A Holistic Perspective

Utilizing Xero as a comprehensive accounting system transforms it into a strategic asset, providing:

- Accurate and Integrated Financial Records: All journal entries, including year-end adjustments and depreciation, are made directly within Xero. This ensures that the system’s balance sheet and profit and loss statements consistently align with statutory filings and provide a true, up-to-date financial picture.

- Robust Fixed Asset Management: Fixed assets and their depreciation are tracked consistently month-by-month within Xero. This provides greater transparency on the balance sheet, reflecting the company’s investments and overall financial position accurately.

- Meaningful Reporting for Strategic Decisions:

- Accrual Accounting: Moving beyond a cash basis for VAT (especially as turnover approaches the £1.6 million threshold) provides a truer view of company performance, matching income and expenses to the periods they relate to, regardless of cash flow.

- Detailed Profit & Loss Analysis: By accurately classifying all costs (e.g., reclassifying PPC expenditure from P&L to the balance sheet when it’s a client cost, not a business cost), Xero can provide relevant gross margin and commercial understanding.

- Tracking Categories: Implementing tracking categories allows for segmented reporting (e.g., by location, department, or service line like SEO vs. PPC). This provides granular insights into the profitability and costs associated with different areas of the business, enabling data-driven decisions on resource allocation and strategy.

- Proactive Financial Management:

- Improved Receivables Management: Identifying and addressing overdue invoices promptly, and making bad debt provisions where necessary, ensures the balance sheet accurately reflects collectable assets.

- Clean Data for Future Analysis: By maintaining accurate and reconciled data throughout the year, businesses can generate reliable historical comparisons and forecasts.

The Key Differences Illustrated:

Conclusion: Empowering Business Growth

For businesses to truly leverage Xero, the mindset needs to shift from it being just a bookkeeping tool to a dynamic accounting system. This involves a commitment to accurate data entry, consistent reconciliation, and proactive use of its features like tracking categories and proper asset management. Ultimately, understanding and embracing Xero’s full capabilities empowers founders and management with the accurate, real-time financial data needed to make informed decisions, drive growth, and truly understand the pulse of their business.