Building Beneficial Benefits

A benefits package can often make the difference between a good employer and a great employer. Providing benefits to your team is a fantastic way to positively build upon your agency’s culture. You may have been considering how to get started, or even expand on what you currently have available.

You’re not alone in this as according to our recent poll so are many of the agencies we work with:

Whether you’re looking to improve the attractiveness of your roles to new recruits, work on your retention rates, or reward your team for their hard work, there are a number of options available to you. Getting started can be daunting, but it doesn’t have to be.

Where do I actually start?

Start where you’re already an expert. What is it about the realities of working for your agency that you’d like to strengthen? Talk to your team and ask them what they would like to see in those areas and to see if there is anything that you may have overlooked. Be open to ideas and suggestions, and this should give you a good indication of where to start looking so that you can start to build a budget.

No-one knows your team better than you, but there are some general trends to consider:

Flexibility

After the introduction of home working for nearly everyone during the pandemic, many people are now actively choosing which employment opportunities they go for based on how much flexibility there is around hours of work. This flexibility is particularly important to those who have parental or guardianship responsibilities. As an added bonus, a degree of flexibility with working locations will also allow you to draw from a much wider pool of talent to ensure your future successes.

Finances

With no end in sight for the housing crisis, and the cost of living generally in an upward trend, any assistance towards your employee’s financial situation is going to be well received. Payroll savings schemes, credit union agreements, discounts and help towards the costs involved in working are all very popular with new and existing staff alike.

At the more generous end, you could consider assisting your team with saving towards a deposit for their first home, or moving costs via bonus payments.

Benefits that look ahead to retirement are also very helpful to employees and a very easy way for you to increase the desirability of your roles, since by law, you must have a pension scheme set up for your staff.

Wellbeing

Healthcare, mental health support and annual leave all work together to ensure that your staff are empowered to work towards the best version of themselves. Investments in staff wellbeing have a positive effect on absence rates and can work to massively reduce your costs related to absence management. This can range from practical support, such as medical insurance to more general support in the form of access to wellness platforms or company funded counselling services.

According to the Office of National Statistics (Q1 2022), 25% of employers are concerned about the mental health of their employees and 40% of employees surveyed reported that their job is the biggest factor that is negatively impacting their mental health.

This may not be a surprise given that we’ve all collectively been through a source of global stress in recent memory, but the emotional fallout from events like the pandemic can leave a lasting mark. Supporting the team that got your business through those tricky times will only pay dividends.

Progression

All employees are interested in their future and the direction that their careers are going to take, whether this is career progression or the road to retirement. Investments in training programmes, professional memberships and pensions schemes can all help your staff to see their long term path with your agency clearly. There is no such thing as a certain future, but you should look to reduce the variables and provide your team with a feeling that there’s a plan in place.

Role specific training is also considered a tax free benefit, and although training that is not directly role related is taxable, that doesn’t mean you can’t occasionally throw a curveball in there to keep things fresh. An afternoon of floristry or meditation in a tech focused environment could be just what your team needs for a reset and could open eyes and minds to possibilities outside their working life.

It could also be that you do not have the scope to implement any specific progression routes due to limitations caused by the size of your agency. This is where benefits for training and development can really shine, by allowing your employees to grow without completely changing the way you work.

Building from the Basics

Not every benefit has a financial cost. Some are investments of time, and others are almost entirely passive in nature.

Once you have a good idea of what your team would benefit from, look for a simple solution. Not everything needs to be complicated, and nor should you start at the deep end. Some examples to consider are:

Flexible Working

For the cost of a variation to contract letter, and some extra admin time for your managers, you could offer a Flexible Working Arrangement such as Flexitime. Although you may need to allocate some time to keeping track of everyone’s comings and goings, this doesn’t necessarily translate into a financial cost for the business.

Pensions Related Benefits

You could also consider offering a pensions related benefit such as increased employer contributions, which can be put in place from your next payroll and do not require you to declare them to HMRC. Since you legally have to have a pension provision in place for your employees this is one of the simplest Benefits in Kind to start with, and carries no additional tax burden.

Health Insurance

Health insurance is also many employer’s first toe in the water with Benefits Packages. Although we are fortunate to have access to the National Health Service, the wait times for some treatments are long and subject to complicated referral processes, and items such as eye tests and vision correction are not included. It is also very easy to payroll and declare these benefits to HMRC through a P11d as this is a popular benefit.

You do not need to throw the kitchen sink at this either! Sometimes simpler is better, and you can change to a more tailored plan at a later date.

Working from Home Allowance

You can choose to pay a £26 per month payment to your employees, which is tax free and does not need to be declared to HMRC. Although this is a relatively modest sum by today’s cost of living standards, every little helps! The previous Working from Home Tax Allowance is now much more difficult to apply for and many employees no longer qualify under the current guidance. The WFH allowance also gives your employees access to their allowance straight away, whereas the Tax Allowance may not convey the full £26 per month to your employees (depending on their tax status).

If you’re interested and would like some ideas, HMRC has curated some very helpful lists of both taxable and non-taxable benefits. We’d also be happy to assist you in figuring out where to start and how to move forward. Contact your usual relationship owner or contact us at [email protected] or by calling 0161 711 0810

How does the tax work?

This is often one of the biggest concerns for employers considering a benefits package but despite the percentile calculations involved, working out the tax is relatively simple. If you have chosen to offer your team a benefit that HMRC defines as a taxable benefit, then you will need to prepare P11ds for any staff who opt into your Benefits Package.

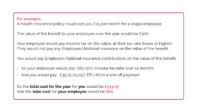

The tax due is calculated on the total value of the Benefit in Kind [BIK] transferred to the employee. This is generally the monthly cost to you, but depending on the service may be higher or lower.

If this was declared via P11d, the tax due would then be paid in the year that follows through an adjustment to your employee’s tax code. You would also need to make the NI payment due before the end of July. The NI cost for Benefits in Kind is often much lower than simply increasing staff wages which makes it a much more affordable incentive.

We have a P11d service as part of our payroll function that can assist you with declaring and paying liabilities owing.

We can also set you up for Payrolled Benefits, where the tax due is paid month to month as part of your regular liabilities.

So where now, from here?

If you’re considering starting or increasing the size of your benefits package, we can assist you. Whether you’d like some assistance with budgeting, research or application of your benefits package one of our team here at MAP can help you find the way to your future success.

Having a comprehensive HR and remuneration package is an essential step along the path towards your agency’s financial maturity, and one that will set you, your culture and practice above your competitors. You don’t have to move mountains or spend an absolute fortune, and getting started could be as easy as sending us an email.

We’re looking forward to hearing from you.