Finance is an essential function of any business, but it can also complete the leadership picture and enable the development of an increasingly sophisticated digital agency.

When agencies reach that level, it’s a real temptation to think that what is required next is a Finance Director, which is probably not the case.

If you scratch below the surface this is often driven by a feeling that more commercial scrutiny is required, which the current business leaders don’t have the time or bandwidth to address. There are also times where specialist professional advice is not just advisable but required for the best outcome.

Employing more people just to bring in high level skills is impractical and expensive, especially as priorities and challenges you face today are probably not going to be the same in six months time. You get to a point where you need the appropriate skills on a more targeted project basis than a full time, part time, or contracted arrangement.

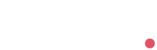

Agencies at this level are often experiencing the demands of the Extended phase on the Finance Maturity Curve – the model we use to help agencies assess the strength of their business model.

This awareness often means finding a translator to and from the board to the rest of the team, as well as someone who can investigate, question and coach practical answers to challenges wherever they lie.

Some of this means rolling your sleeves up and asking questions of both the team and the data, while at other times it means accessing a bank of experts who can help with technical accounting, legal and finance matters.

Extended means extending the team without increasing your overheads, bringing the expertise that you might be missing without the permanent cost.

To help evaluate where you are on the Finance Maturity Curve, and to signpost what needs to be in place in order to increase Extended effectiveness we have created the simple to use Finance Maturity Scorecard – Take the test now

|

“Too many businesses make life hard for themselves by not having the right financial maturity in place. By following this methodology, you will be running a far more robust operating model.” Stuart Brown, Portfolio Non-Executive Director |

The Extended phase of the Finance Maturity Curve is composed of three key elements.

Financial Leadership

An independent and practical voice to challenge, uncover and deliver

Having the insight, interpretation and investigative skills of an experienced finance professional are important ones to be able to be called on.

Being able to deploy this level of resource within the business is the responsibility of the senior managers and board, who often recognise the independence of an external commercial finance partner and the accountability that it can drive.

Within the life cycle of every growing agency there comes a limit to the understanding and oversight that can be guaranteed by those working within the business day in day out. This is a dynamic and not necessarily a fault or weakness. As MD’s focus their time more on developing the business and it’s value proposition, they may lose touch with all the individual processes, and rightly so.

In the same way, a business will often recognise the need for an experienced and independent finance voice at board meetings to provide the correct level of challenge to the businesses activities and it’s strategy.

Financial Leadership internally therefore is as much about understanding that there is a need that requires the skills of an external professional on a project basis.

To be clear, this is not necessarily a full time requirement. Having someone who can be both strategic and deeply practical is often a significant expense.

Financial Leadership recognises that the business needs to continue to evolve, and that this has as much to do with leading the people who interact with (as well as sit in) finance, as it is about being the connector between the business and the key decision makers.

Mapping The Strategy

Providing clarity and focus on strategic direction

Another aspect of Financial Leadership is helping to execute a longer term strategy and not just the plan around the annual budget.

A clear view of what the business and personal ambitions of the business owners are is at the very heart of this. Once the direction is properly understood, with documented clear goals, then the mechanics of the business can be engineered with intent to deliver.

Mapping the Strategy should be a defined process that provides an opportunity to stand back from the day to day and take a dispassionate view.

A thorough approach will provide agreed goals as well as an understanding of what the business needs to look like over a 1, 2 and 3 year period. This should respect every aspect of the business: high level financials that lead into looking at client numbers, honing the service offering and the make up and skills within the team.

Financial leadership can help weave all these things together, assembling a credible story for the whole organisation.

Specialist Services

Accessing appropriate professional services

An aspect of Financial Maturity is developing the business to the extent that it will need access to professional external advice in specialist areas.

Typically these are more front and centre in the minds of board members who are not embedded in daily operations. They are strategic matters that require a level of technical or financial expertise to execute key parts.

These can be far ranging: Incentives, share option schemes and employee benefits as part of a wider plan to attract, retain and reward staff for example. Or, preparing and marketing the business for sale, buying out an existing shareholder or acquiring a complementary business could require access to funding, tax advice, financial due diligence and legal support.

These matters need to be coordinated by a professional as they are often processes that can derail without guidance and the right information being supplied at the right time.

Working with someone who understands the implications, who can pull the threads together and advise on the best ways of doing things, can ensure you get the best possible outcome within the boundaries of what is permitted by legislation.

Finance as a true partner

Without the Essentials and Enhanced aspects of Financial Maturity in place, operating, understanding and making decisions is made harder. With these platforms established however, it’s much easier to have peace of mind that your commitments are being met and you have oversight of the mechanics of your business and the direction you are heading in.

Extending beyond these is where finance becomes a true partner: Sector expertise, accounting, tax, and specialist services – deployed as required, to work with your existing teams, and on commercial aspects of your business that aren’t economical to retain specialists permanently.

MAP aspires to be that effective extension of your team. Building a deep understanding and wrapping around the complete lifecycle of your business, with services that can be brought in when it’s most right to do so.

To see where your agency sits on the Finance Maturity Curve, and how working with MAP could deliver by becoming part of your Extended finance team